1. London. Once again, Frieze Art Fair opens its tent amid global economic uncertainty. The contemporary art fair faces the now familiar pressure of being the market’s first test of health following a summer of discontent. While it isn’t quite the dramatic downturn of 2008, the risk of recession in Europe and a serious slump in the US are unappealing realities. And now there’s a new

problem: a slowdown in China, the country that has been powering the global economy—and propping up confidence in the art market—for the past few years. “Evidence is building [that] the art market could pause… [Wall] Street is discussing a China hard landing,” says David Schick, a market analyst with the US investment bank Stifel Nicolaus.

Cooling the craze

So, what now? The dealers congregating in the tent this week are keeping their chins up. Those with plans in Asia say that these are still on track (although little has progressed). “It’s a new economy that we’re all trying to understand,” says David Maupin of Lehmann Maupin gallery, which is planning a pop-up space in Singapore. Those in China say that, while confidence is still high, a cooling of the contemporary craze may not be such a bad thing. “People don’t want to slow it down, but it’s arguably moving too fast,” says Lu Jie of Beijing’s Long March Space (E20). “There are too many people who think of art just as an investment,” he says (there are believed to be nearly 40 art investment funds in China).Others accept that times are tough, but say China should be approached with a long-term game-plan. “The reality is more exciting than the hype. There is huge potential but it is going to take time and effort to build relationships,” says Magnus Renfrew, the director of Art HK. David Roberts, the property developer and contemporary art collector, says: “While China may take a dip in the short term, it will potentially be a huge market in the future. [The galleries opening in Hong Kong] are shrewd operators.”The art economist Clare McAndrew can also see advantages of a slowdown in

China. “The government will be looking to get people to spend more to help sustain growth. There is only a very small handful of rich Chinese buying art —but bring on the new middle class,” she says.

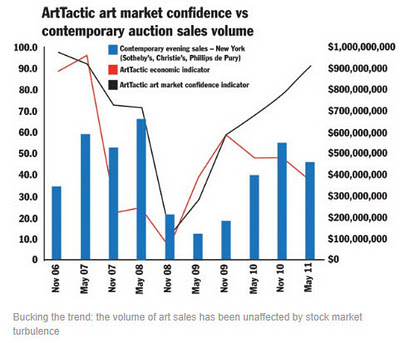

Meanwhile, the rest of the world remains the immediate cause for concern. “We have a global outlook but our footprint is in the US, so we’re more worried about that economy,” says Courtney Plummer of Lehmann Maupin. ArtTactic’s latest market confidence report, released on Monday, showed a

55% fall in confidence since June and a negative outlook for the US and European contemporary art markets for the first time since autumn 2009. But, says Plummer, “the great thing is that Frieze kick-starts the season”.Amanda Sharp, co-director of Frieze, said yesterday: “We have been blessed

with good weather and there are great shows in the museums, so it feels like the right ingredients are in place.” With art worth an estimated £225m on sale at the fair and a potential total of £110m coming to auction in London this week, many others are hoping the same.

2. Art market jitters over financial turmoil

Nervous investors have rushed to safety in gold and the Swiss franc but art looks more volatile

By Melanie Gerlis | From issue 227, September 2011 Published online 12 Sep 11 (News)

• Is art still a safe bet for investors?

Fears are growing about the potential impact of this summer’s renewed global economic turmoil on the art market. The 2008 financial crisis sharply hit art sales across all sectors, but the market bounced back quicker than many others, particularly for blue-chip works. At issue now are two diverging

premises: that art is a luxury brand, as sensitive to stock markets as high-end fashion and first-class flights (this is the view of those looking at the art market from the outside); or that it represents a safe investment, sought after in troubled times much like gold and the Swiss franc (the view of those with more vested interests). Dark clouds Since art market professionals went on their summer break, the widening European sovereign debt crises and Standard & Poor’s downgraded opinion of the US debt triggered fears of a “double dip” recession, which saw stock markets fall worldwide.The wealthy, especially in cities such as London and New York which rely heavily on their financial centres, all now have less to spend. The hedge fund SAC Capital, run by the art collector Steve Cohen, was down 4% for the first week of August alone. In the luxury goods sector in Europe, share prices are down between 15% and 30%. “We see significant potential downside if the crisis mimics 2008,” said

Julian Easthope, a research analyst at Barclays Capital in London. He looks closely at stocks, including France’s PPR, founded by Christie’s owner François Pinault.

Sotheby’s stock has certainly felt the pinch: since 7 July, it has lost 37% of its value (falling from $47.8 to under $30, as we went to press), wiping over $1.2 billion off the value of the company. This reduces the money available to it at a time when competition with Christie’s is already eating into its profits. In the fight for the best works, both auction houses need to offer increasingly attractive terms to consignors, which is reducing Sotheby’s profit margins (see p59).Safe as houses?

Others say that some of the lessons learned since the 2008 financial crisis are reasons to be more confident in the art market. “There was much more of a shock when the banks started collapsing. Then the [art] market reconfigured as the rain washed out some of the speculators and short-term engagers,” said art advisor Allan Schwartzman. “What has been validated in the last few rounds of uncertainty is that art is a genuine form of capital,” he added, comparing it to traditionally safer investments such as gold. This, he said, is reinforced by the near-zero interest rates in the US.In a reaction to the financial crises, gold has hit a new record price, nearing $1,830 an ounce as we went to press, with silver and other precious metals up in concert. The Swiss franc, seen as one of the most reliable currencies,

reached an exchange rate high of $1.28 and nearly equalled the euro for the first time. All agree, however, that one key factor underpinning the potential health of the art market is whether or not the emerging economies, such as China, could pick up any slack should the more traditional markets falter.

Bets on China. The major commercial players are certainly banking on the potential: Sotheby’s chief executive Bill Ruprecht said on the auction house’s most recent conference call to Wall Street analysts that it was cutting back investment in Europe in favour of initiatives in China (see p59). White Cube has become the latest big-name western gallery to open in Hong Kong, its first overseas venture.

But on 9 August, the day after stock markets in Europe and the US collapsed, Hong Kong’s Hang Seng index fell nearly 6% with other Asian stocks (most notably in South Korea). Many economic commentators are also concerned about China’s unsustainable trade surplus. “If there is a market dislocation as in 2008, even sectors of the art economy driven by relatively healthy economies such as China and Brazil could be impacted. But the emphasis is on the severity of a downturn,” said Artvest’s Michael Plummer.

3.Lacklustre mood at Sotheby’s - The Art Newspaper

Most lots sold for under or around low estimates By Melanie Gerlis | From Frieze daily edition, 14 Oct 11Published online 14 Oct 11 London. Credit must be given to Sotheby’s (and its fast-paced auctioneer Oliver Barker) who managed to sell an uneven selection of works at last night’s

contemporary art sale. The mood was lacklustre as most of the lots sold for under or around their low

estimates, after bidding from only one or two parties—but sometimes that is all it takes.

One of the higher quality lots, Lucian Freud’s finely painted 1952 Boy’s Head portrait of his young neighbour Charlie Lumley, sold on its second bid for a hammer price of £2.8m, under its £3m-£4m estimate that dealers felt was “punchy”. Of the 47 lots on offer, 11 went unsold, a respectable sell through rate of 77%. The sale total was £17.8m (once premium was added), just below its £19.1m-

£26.6m pre-sale estimate.

4. LONDON (REUTERS).- Walk into the giant marquee in Regent's Park, London, venue of this year's Frieze Art Fair, and enter a parallel universe. Impeccably dressed men and women, and a healthy smattering of Bohemian types in garish trousers and expensive, thick-rimmed glasses, saunter down the aisles and between the stands of more than 170 exhibiting galleries. There the "new aristocracy" browses the cutting edge of contemporary art, from a grotesque Madonna and Child by the Chapman Brothers to a golf bag full of cement and a section of wooden fence hanging on a wall.

Elle Macpherson and designer Valentino joined commercial gallery A-listers like Jay Jopling in assessing what was hot and what was not at a VIP preview this week. The fair opened to the public on Thursday and runs until Sunday. Prices range widely, but generally works on show go for between five and seven figures, the sort of money most people spend on their house, often by way of a 25-year mortgage. Not so at Frieze, which has become a magnet for the world's biggest contemporary art collectors who think little of writing a check for a few hundred thousand dollars or more. The disconnect with the world outside, where markets are jittery and volatile, people fret over their jobs and countries are weighed down by crippling debt, is striking. Whether that disparity can last is the question on every gallery owner's lips. While there will always be ultra-wealthy buyers snapping up the rarest and finest works, supporting the million-plus market, there are concerns that

"lesser" art will fail to sell. The contemporary art market contracted sharply in late 2008 and early 2009 in the wake of the Lehman Brothers collapse before recovering strongly in 2010 and 2011.

"lesser" art will fail to sell. The contemporary art market contracted sharply in late 2008 and early 2009 in the wake of the Lehman Brothers collapse before recovering strongly in 2010 and 2011. Market surveys suggest confidence in all but the top lots -- viewed as an alternative investment at a time when so many markets look risky -- is evaporating fast, raising the prospect of another correction.

MIXED SIGNALS

At Frieze, David Zwirner sold a Neo Rauch painting for $1.35 million, and the overall value of art on show is estimated at around $350 million, down from $375 million in 2010. At the nearby Pavilion of Art & Design, an offshoot of Frieze featuring mainly older works, the Van de Weghe Fine Art gallery sold an Alexander Calder for $1.5 million and Sladmore Gallery raised 500,000 pounds for a cast bronze by Rodin. But not all the signs are good. While fairs do not publicize their revenues, and most dealers keep their business to themselves, auction houses also hold a series of sales during Frieze

week which give some indication as to the strength of prices. Sotheby's had its main auction on Thursday evening followed by Christie's on Friday, but Phillips de Pury held its big sale on Wednesday and the results were described by one specialist art website as "tepid." The auction tally of 8.2 million pounds fell comfortably short of the pre-sale low estimate of 10.1 million (and high estimate of 14.6 million), and a third of the works on offer failed to sell. Jeff Koons' "Seal Walrus Trashcans" fetched 2.1 million pounds, at the bottom end of expectations, and Damien Hirst and Richard Prince were among the familiar names featuring in the top 10. "The sale showed there is still an appetite for good quality works from blue-chip artists," said Peter Sumner, head of contemporary sales, London Phillips de Pury & Company. Of course, many artists dismiss talk of markets and prices. In most cases they stand to gain little even if their works sell for millions at auction, and money, they argue, is not the point.

Some, however, actively engage in the concept of art as a commodity. The artistic partnership called Claire Fontaine has a work at Frieze which reads: "This neon sign was made by Vladimir Ustinov for the remuneration of one hundred and sixty-nine thousand rubles." For those less confident in their economic future, artist Michael Landy may have the answer with his outlandish "Credit Card Destroying Machine." (Editing by Steve Addison)

No comments:

Post a Comment